Award-winning PDF software

Irs Form 2290 Due Dates For The Tax Year 2018-2025: What You Should Know

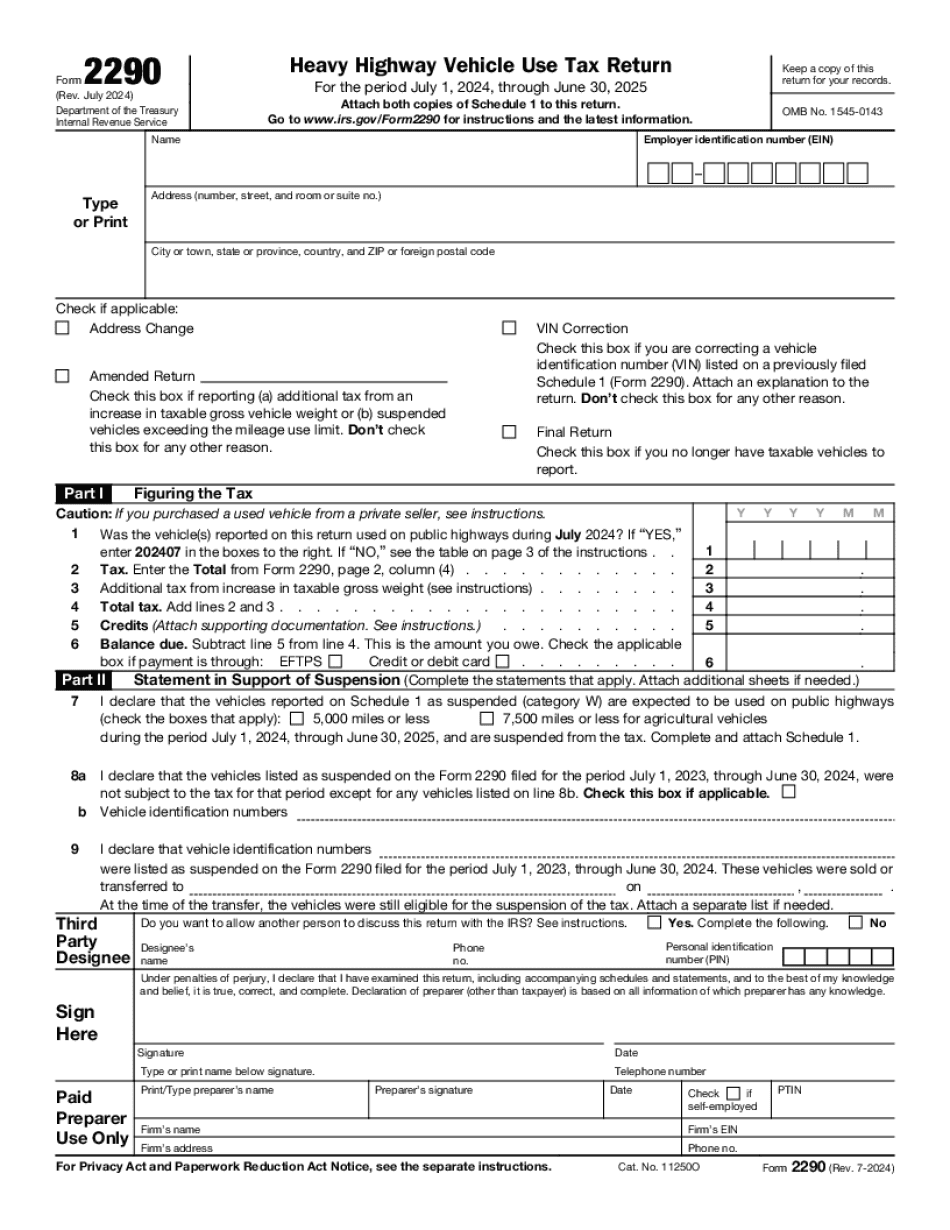

In-service tax filing for 2025 – 2025 tax year — Motor For a vehicle used on public highways during 2 tax period, you must file Form 2290 by Sept. 1. A Form 2290 may not be Failing To File (Cont.) Not filing on time is not an excuse to avoid the late penalties. You may still pay late in full if your car is in service. You will have to pay tax at the usual late filing date for tax period of that year (noting the time you began to make payments). If You Filed Your Tax Return on Time | Internal Revenue Service Form 2290 (Rev. July 2019) — IRS 13 Filed for tax year ending Sept. 30, 2025 and paid on or before Dec. 31, 2018. Form 2290 should have been sent to you by June 2017. However, if you haven't received a Form 2290, contact the collection agency that sent you a Form 2290 if you expect to be collecting your tax Filing for tax year ending Sept 30, 2025 and paying by Dec. 31, 2025 is an early filing penalty. However, late filing a delinquent tax return may result in an interest penalty. Late payment penalties and interest are assessed against your future tax as of the due date of your return. The interest amount calculated on your delinquent tax payment is a collection charge. You get a notice of the collection charge by mail from your collection agency. The notice lists the interest due on your delinquency that is due at the time of the late penalty. If you don't pay the penalty or interest in the due date, the collections' agency sends you a notice directing you to make payments to be charged against your future tax. If a collection agency collects your tax before it gets to you, a lien will be placed against your vehicle, causing it to be sold at auction. If you paid the 400 late tax by credit or debit card, the IRS collects 40, and you pay the 400. You can have the late tax collected by the credit or debit card company using a pre-printed letter addressed to the collection agency, or you can file a claim with the IRS for a refund of the interest and penalty. If the loan amount is between 400 and 1500, you must file Form 1040-X, U.S. Income Tax Return for the tax year that includes the due date.

Online systems assist you to to arrange your document management and enhance the efficiency of your respective workflow. Comply with the fast handbook in order to carry out IRS Form 2290 Due Dates for the Tax Year 2018-2025, stay away from problems and furnish it in the well timed fashion:

How to complete a IRS Form 2290 Due Dates for the Tax Year 2018-2025 internet:

- On the web site aided by the kind, simply click Launch Now and move to your editor.

- Use the clues to complete the appropriate fields.

- Include your personal info and phone data.

- Make positive that you simply enter accurate info and figures in ideal fields.

- Carefully verify the articles belonging to the sort as well as grammar and spelling.

- Refer that will help part when you have any questions or deal with our Help staff.

- Put an electronic signature on the IRS Form 2290 Due Dates for the Tax Year 2018-2025 when using the guidance of Signal Software.

- Once the shape is completed, press Performed.

- Distribute the all set kind through electronic mail or fax, print it out or help you save in your machine.

PDF editor allows you to definitely make variations to your IRS Form 2290 Due Dates for the Tax Year 2018-2025 from any on-line linked equipment, customize it as outlined by your requirements, indication it electronically and distribute in various methods.