Award-winning PDF software

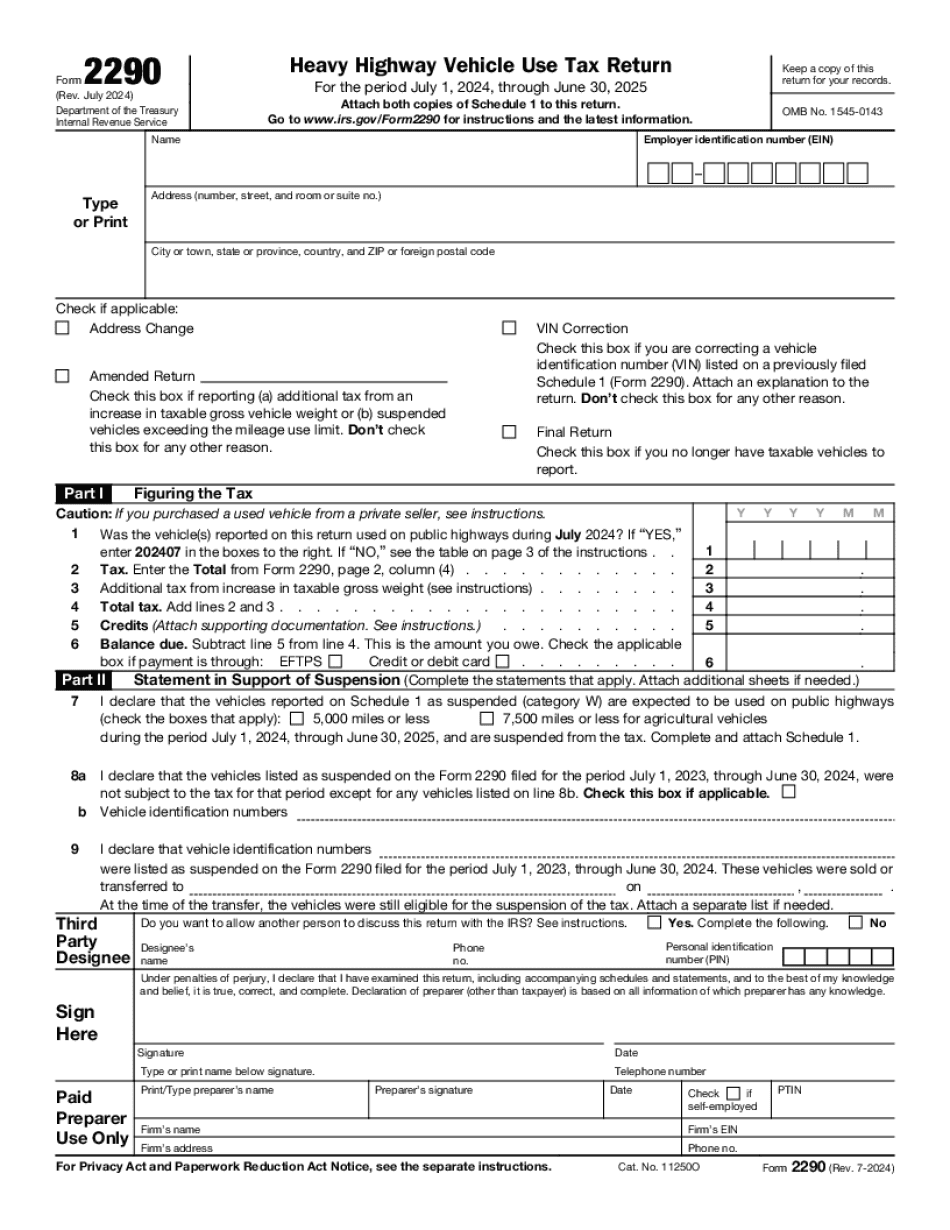

2290 Taxes Are Due Now For 2025 – 2025 Tax Period - Truck Dues: What You Should Know

Rules for the Deduction by the Income Tax Regulations (PDF) Sep 8, 2025 — You have the option to defer the payment and use the refund in case more time is needed to register the vehicle. You will be allowed to defer up to 25 of the tax due per person. You may use the deferral to reduce the amount paid from your gross income. What to Do with the Refund The amount you used to pay the tax is called a “deferral.” You can use this money to reduce your Gross Income (PDF) CAUTION: You can't use the refund to decrease the amount of tax due for the same vehicle. If you get more tax after making the deferral payment, you must pay the remainder. CAUTION: You can deduct the amount you used to pay the tax on your Schedule C (Form 1040) and Schedule A (Form 1040EZ). CAUTION: You can also defer the amount of the tax you paid on your Form 2290 and take the balance as income. A 1099-INT may give this amount, but the 1099-INT is for reporting information about income. Calculating the tax liability See the instructions of Form 2290 to find out how many tax days remain until Form 2290 is due. When to file Form 2290 is due by August 31 each year or sooner if the vehicle is more than one tax year old. If filing electronically, fill out Form 1040X, Application for Electronically Filed Federal Income Tax Return , and send it and supporting documents, such as the application for Federal Individual Identification Number (available here). The Form 2290 and the supporting documents (such as the Schedule A and supporting documents) can be obtained at IRS.gov/Forms2290, or you can call the Federal Motor Carrier Safety Administration at (toll-free) or (free). Taxpayers can also get Forms 2290 at IRS.gov, but it is not always available. More info: You must fill out Form 2290: Federal Annual Gross Income Disclosure for Tax Year 2018, in full and return it to the Motor Carrier Division, which makes final determinations on tax liability, by the due date of the return, and returns are due annually by April 15.

Online options assist you to to prepare your doc management and strengthen the efficiency of one's workflow. Stick to the fast guideline so as to total 2290 taxes are due now for 2025 – 2025 tax period - Truck Dues, prevent mistakes and furnish it inside a well timed way:

How to complete a 2290 taxes are due now for 2025 – 2025 tax period - Truck Dues internet:

- On the website using the sort, simply click Start out Now and go towards editor.

- Use the clues to fill out the applicable fields.

- Include your personal info and call knowledge.

- Make sure which you enter suitable information and numbers in acceptable fields.

- Carefully test the content within the variety at the same time as grammar and spelling.

- Refer to aid part if you've got any problems or address our Support workforce.

- Put an electronic signature on your 2290 taxes are due now for 2025 – 2025 tax period - Truck Dues with the help of Indicator Software.

- Once the shape is completed, press Undertaken.

- Distribute the ready kind by using e mail or fax, print it out or preserve with your unit.

PDF editor permits you to make changes towards your 2290 taxes are due now for 2025 – 2025 tax period - Truck Dues from any online world related machine, customize it according to your needs, indication it electronically and distribute in numerous approaches.