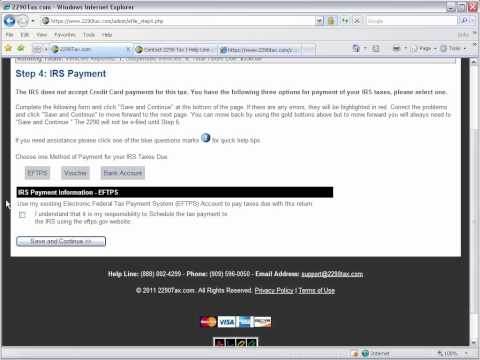

Thank you for calling 2290 tax. This is Casey. Hi Casey, how are you? I'm great, how are you? I'm doing good, just have a little question here on your website. I'm gonna step for IRS payment and I really do not know and/or understand what's happening on this page. Okay, this is how you pay your IRS taxes. Okay, so you have the three options that are listed here. Do you see those? You can choose EFTPS, right voucher, or bank account. Okay, so EFTPS is the Electronic Federal Tax Payment System. It's a government website and you can schedule your payments electronically through them. Okay, so if you want to choose that one, you just click the button that says 'I understand it's my responsibility' and you'll save and continue. Okay, the voucher allows you to put a check or money order in the mail to the IRS. So you'll check both of these options and then you'll open this payment voucher and it looks like this, and you'll just put it in the mail with your check or money order. Got it? Okay, and your last choice is your bank account. You can actually allow the IRS to take the funds directly out of your bank account. You just list the bank name, routing number, and account number. So get that information maybe from a check. Yeah, you can see it on the bottom of all your checks. Awesome! Well, thank you so much Casey. No problem, you have a good one. Okay, you too. Bye.

Award-winning PDF software

2290 due date 2025 Form: What You Should Know

Form 2290 & Excise Tax Compliance — NC.GOV. Note: Your filing deadline is based on the calendar year. If you file it on July 1, you must file it before August 31, 2018, for 2025 – 2025 tax period. Filing and Payment of Excise Tax Due on Excess Revenue Motor Vehicles Note: For tax year 2, the filing and payment of excise tax due on excess revenue motor vehicles applies only to property that exceeds 300.00. All excess revenue motor vehicles are subject to excess revenue tax. This amount is due on the amount by which the tax and/or excise tax on the excess revenue motor vehicle exceeds 300.00. For tax year 2, the filing and payment of excise tax due on excess revenue motor vehicles applies only to property that exceeds 300.00. All excess revenue motor vehicles are subject to excess revenue tax. This amount is due on the amount by which the tax and/or excise tax on the excess revenue motor vehicle exceeds 300.00. Example: Bob enters the trade name of an auto dealer operating in North Carolina. The vehicles are listed as “BARNETT” on his North Carolina state license. For the tax years 2, the tax on the vehicles is 2,500.00. Bob enters the trade name of an auto dealer operating in North Carolina. The vehicles are listed as “BARNETT” on his North Carolina state license. For the tax years 2, the tax on the vehicles is 2,500.00. Bob may, in a separate statement, list, on the “Total Gross Revenue” line, the gross sales of the vehicles from the time Bob purchased the vehicles to the time he entered the business as a dealer. The “Total Sales” and “Total Gross Revenue” columns, of the separate statement of facts, will be the total sales on the date Bob entered the trade name of the auto dealer on January 4, 2018. BARNETT sales: 300.00 300.00 Sales in North Carolina for 2018, 2019, and 2020 Bob's statement must be accompanied by a filing fee of 15. Please do not use your bank statements or paychecks. Please DO NOT include any personal documents with the Statement of Facts in these transactions. We will not be able to process your tax return without them. We accept cash, check, or wire transfers.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2290, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2290 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2290 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2290 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2290 due date 2025