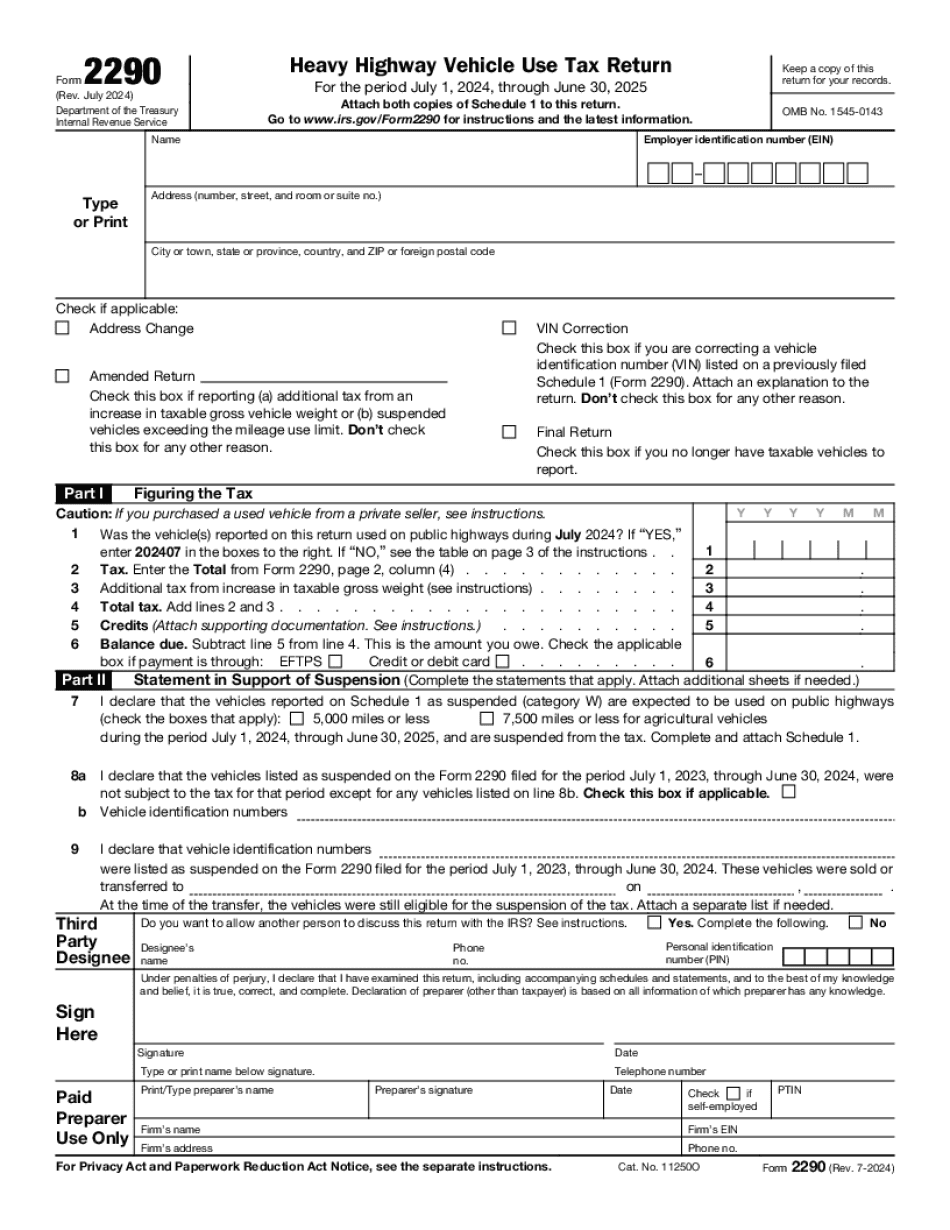

To register, click the "register here" button in the corner. Enter the following information in the fields: full name, email, confirm email, password, verification code. Then click the blue "register" button. This will bring you to your dashboard. In the middle of the page, you will see a link that says "click here to add a new business". Click the link and enter the personal information and business name. The business name must match the paperwork for your EIN. Select the business type from the employer identification number (EIN). The EIN must be nine digits and older than two weeks. Provide your contact information, including the address (including suite, unit, or P.O. number), state or province, city or town, zip or postal code, and phone number. Enter your signing authority information, which should be your own name, not your company. Include your title and daytime phone number. Create a five-digit PIN, which is for verification purposes. It can be any number, like "12345" or "54321". If you are an accountant or certified third party completing this form for another person or company, check the third party designee information and enter your name, phone number, and PIN. If not, you can skip this section. Once you have completed all the information, click the blue "Save" button. Congratulations! You have successfully created your account and added a business. You will see the business listed on your dashboard with a link to start filing.

Award-winning PDF software

2290 2019-2025 Form: What You Should Know

You must complete this form every year unless it's a one-time adjustment. If you filed your gross vehicle weight tax return for 2025 through 2019, you also have the option of e-filing your taxes for the period beginning on March 1, 2019, and ending on May 31, 2019. You can check the “Yes” box on page 1 to file online. In general, the electronic file fee for e-filming your taxes online is only 2.00. Online (2018 – 2025 tax period only): Fees for e filing: E-File Application Fee 9.00 Fee for the completed and signed E-Filing Electronic File: 9.00 Fees for filing your paper E-FILE: 4.00 How to make and use an Electronic Filing Schedule Download the instructions for making and using an Electronic Filing Schedule, including information about filing an Electronic Filing Schedule and how to pay. Electronic Filing Schedule Instructions Filing Online — Tips & Guidance Information about filing your electronic Federal income tax returns. Get tips and guidance about filing online or by telephoning. Free. Available 24/7, 24/7 access. Online Filing Tips and Guidelines for Tax Year 2016 Filing Online for 2025 Federal Income Tax — Tips & Guidance Information about filing your federal tax return electronically: Tips for paying taxes online and how the U.S. Department of the Treasury's Electronic Filing Center (EFC) works with you and your tax preparer to help you pay your tax bill electronically and reduce your processing time. You Can Pay Online You can pay your tax bill or refund online. You can also pay electronically as a courtesy to the IRS. For more information on filing your paper tax return and paying electronically, go to: Paper & Electronic Filing Links, or call: Telephone Tax Tips We help to guide taxpayers and help them with tax filing, tax matters, online taxes, and other tax matters online.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2290, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2290 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2290 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2290 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2290 Form 2019-2025